Tennessee is one of the fastest-growing construction markets in the country, especially in Nashville and Murfreesboro. With new residential builds, commercial developments, renovations, and investment properties happening year-round, protecting projects during construction is critical. That’s where builders risk insurance in Tennessee comes in. Whether you are a contractor, property owner, real estate investor, or developer, understanding how builders risk insurance policies in Nashville and Murfreesboro work — and how to avoid overpaying — can save you time, money, and stress. This guide explains what builders risk insurance is, who needs it, what it covers in Tennessee, and why prorated builders risk insurance policies offer a major advantage for construction projects in Middle Tennessee. What Is Builders Risk Insurance? Builders risk insurance, also known as course of construction insurance, is a temporary property insurance policy that protects a building while it is under construction, renovation, or major remodeling. Standard property insurance does not cover structures during construction. Builders risk insurance fills that gap by covering damage to the building, materials, and supplies before the project is completed. In Tennessee, builders risk insurance is commonly required by: Construction lenders Banks and mortgage companies Investors Developers Property owners acting as general contractors Why Builders Risk Insurance Is Essential in Tennessee Construction projects in Middle Tennessee face unique risks due to weather, growth, and location. Builders risk insurance in Nashville and Murfreesboro is especially important because of: Severe thunderstorms Tornado activity Heavy rainfall and flash flooding High winds and hail Construction theft and vandalism Rapid development and tight timelines A single weather event or theft loss can result in tens or hundreds of thousands of dollars in damage. Without builders risk insurance, those costs fall directly on the builder or property owner. Who Needs Builders Risk Insurance in Nashville and Murfreesboro? Builders risk insurance in Tennessee is not just for large commercial builders. It is commonly used by: Residential home builders Commercial contractors Custom home builders Real estate investors House flippers Developers Homeowners doing major renovations Property owners serving as their own general contractor If a project changes the structure, value, or footprint of a building, builders risk insurance is typically required — especially in the Nashville metro area. What Does Builders Risk Insurance Cover in Tennessee? Coverage can vary by policy, but most builders risk insurance policies in Tennessee include protection for: Covered Property The building under construction Foundations and framing Roofing and exterior materials Interior build-out and finishes Fixtures and equipment being installed Construction materials on-site Materials in transit or temporarily stored off-site Common Covered Causes of Loss Fire and explosion Wind and hail Lightning Theft Vandalism Certain types of water damage Given the weather patterns in Nashville and Murfreesboro, wind and storm coverage is especially important when selecting a builders risk insurance policy. What Is Not Covered by Builders Risk Insurance? Understanding exclusions is just as important. Most builders risk insurance policies do not cover: Poor workmanship or faulty design Normal wear and tear Employee theft Earthquakes (unless endorsed) Flood damage (separate flood insurance may be required) Mechanical breakdown This is why working with a knowledgeable Tennessee insurance agency matters — coverage can often be tailored or endorsed based on your specific project. How Long Does Builders Risk Insurance Last? Traditional builders risk insurance policies are written for a fixed term, usually: 6 months 9 months 12 months Once the project is completed or occupied, builders risk coverage ends and is replaced with permanent property insurance. However, construction timelines in Nashville and Murfreesboro frequently change due to: Weather delays Permit approvals Material shortages Labor availability This often leads to builders paying for coverage they don’t actually need. What Are Prorated Builders Risk Insurance Policies? This is where our agency stands out. Most builders risk insurance policies are fully earned, meaning if your project finishes early, you do not receive a refund for unused coverage. That results in unnecessary insurance costs. We offer prorated builders risk insurance policies in Tennessee, which means: You pay only for the time your project is under construction If your project finishes early, your premium is adjusted You avoid paying for unused months of coverage Prorated builders risk insurance is especially valuable in fast-moving construction markets like Nashville and Murfreesboro. Why Prorated Builders Risk Insurance Matters in Nashville and Murfreesboro Construction costs in Middle Tennessee are already high. Between materials, labor, land, and permits, budgets are tight. Prorated builders risk insurance helps: Custom home builders reduce overhead Investors maximize profit margins Developers control insurance expenses Property owners avoid overpaying for coverage For spec homes, flips, and renovation projects that finish ahead of schedule, prorated policies can result in significant savings compared to standard builders risk insurance. Why Work With a Local Tennessee Builders Risk Insurance Agency? Builders risk insurance is not a one-size-fits-all product. Working with a local agency that understands Tennessee construction makes a real difference. A Middle Tennessee insurance agency understands: Nashville and Murfreesboro lender requirements Local weather and storm risks Regional building codes Construction trends and timelines How to structure prorated builders risk policies correctly Instead of paying for unnecessary coverage, builders get policies that match their actual project needs. Builders Risk Insurance for Tennessee Construction Projects If you are planning a construction project in Nashville, Murfreesboro, or anywhere in Tennessee, builders risk insurance is a critical part of protecting your investment. Even more important than having coverage is having the right type of coverage. Prorated builders risk insurance policies ensure you are not overpaying for insurance and give you flexibility as your project progresses. In a competitive construction market, controlling costs while managing risk is key — and the right builders risk insurance policy can do both.

When most people think of flood insurance, they picture coastal hurricanes or rivers overflowing in the Midwest. But if you live in Tennessee, flooding is a very real—and growing—threat. In fact, devastating flash floods have struck every corner of the state in recent years, from Memphis to Nashville to the Smoky Mountains. Unfortunately, many homeowners find out too late that their standard homeowners insurance doesn’t cover flooding. At 615 Insurance, we’re here to break down what you really need to know about flood insurance in Tennessee: whether you’re in a high-risk zone, how to get covered, and why it’s one of the smartest additions to your insurance plan. 🌧️ Flooding in Tennessee Is More Common Than You Think Flooding is the most frequent and expensive natural disaster in the United States—and Tennessee is no exception. Here are just a few examples: • In August 2021, catastrophic flooding in Waverly and surrounding areas caused 20+ deaths and over $100 million in damages. • Nashville experienced historic flooding in May 2010, with 13 inches of rain in 36 hours. Over 11,000 properties were damaged. • Regular flash flooding events continue to affect both urban and rural communities across Middle and East Tennessee. Flooding here doesn’t just come from rivers. Tennessee’s hilly terrain, heavy thunderstorms, poor drainage, and rapid urban development have increased the risk of flash floods and surface water flooding, even in places far from bodies of water. 🏡 Does Homeowners Insurance Cover Flooding? No. Standard homeowners insurance does not cover flood damage caused by rising water, overflowing creeks, or flash floods. That means if your basement fills up or water enters your home from the outside, you’re likely not covered—unless you have a separate flood insurance policy. Many Tennesseans don’t realize this until it’s too late, and unfortunately, flood damage can be incredibly expensive . Just one inch of floodwater in a 2,000 sq. ft. home can cause over $25,000 in damage, according to FEMA. 📍 Are You in a High-Risk Flood Zone? FEMA divides land into flood zones, which determine your risk level and whether you’re required to have flood insurance. Here’s a breakdown: 🔴 High-Risk Zones (Flood Zone A, AE, VE, etc.): • Located near rivers, lakes, streams, or low-lying areas • 1 in 4 chance of flooding during a 30-year mortgage • If you have a federally-backed loan, flood insurance is usually required 🟡 Moderate-to-Low Risk Zones (Flood Zone X or B): • Flood risk is lower but still exists • You are not required to buy flood insurance, but over 25% of flood claims come from these areas Even if you don’t live in a red zone, you could still be vulnerable due to poor drainage, steep terrain, or new development changing how water flows. 📊 How to Check If You’re in a High-Risk Zone You can find out your flood zone status by: • Visiting https://msc.fema.gov and entering your address • Asking your lender or mortgage company • Contacting us directly—we’re happy to check for you and explain what it means for your home Don’t assume you’re safe just because you’re not near water. Many Tennessee neighborhoods are seeing changes in flood maps due to climate patterns, construction, and development. 💰 How Much Does Flood Insurance Cost in Tennessee? Flood insurance rates depend on: • Your flood zone • The elevation of your home • The foundation type (crawl space, slab, basement) • The amount of coverage you choose • Whether your home is primary or secondary residence Generally speaking: • High-risk zones: Premiums often range from $500 to $2,500 per year, depending on elevation and coverage • Moderate-to-low risk zones: Premiums may be as low as $200–$500 per year If you live outside a high-risk zone, you may qualify for a Preferred Risk Policy, which offers affordable protection for homes in lower-risk areas. 🧾 What Does Flood Insurance Cover? Flood insurance is available through the National Flood Insurance Program (NFIP) and private insurers. Here’s what NFIP typically covers: ✅ Building Coverage (up to $250,000): • Foundation, walls, floors • Electrical and plumbing systems • Central AC and furnaces • Kitchen appliances • Water heaters • Permanently installed carpeting and cabinets ✅ Contents Coverage (up to $100,000): • Furniture • Clothing • Electronics • Curtains and rugs • Washers, dryers, and portable appliances Important: Flood insurance does not cover damage caused by sewer backups unless it’s directly related to flooding. It also won’t cover temporary housing—you’d need to rely on homeowners insurance (if available) or savings for those costs. 🛠️ What Isn’t Covered by Flood Insurance? Just like with any policy, there are limitations. Most flood insurance will not cover: • Basement improvements (flooring, drywall, etc.) • Landscaping or fences • Swimming pools • Temporary housing or loss of income • Mold or mildew damage caused by delayed cleanup This is why it’s so important to review your policy details—and consider supplemental endorsements or private options where needed. ⏳ When Should You Buy Flood Insurance? Now. Don’t wait until storm season. Flood insurance has a 30-day waiting period before it takes effect (unless it's required by a lender at the time of home purchase). That means if you wait until a flood watch or warning is issued, it’s too late to get coverage. If your property is newly rezoned into a high-risk flood area, or you’ve seen more heavy rains and drainage issues in your neighborhood, the best time to buy is before disaster strikes. ✅ How to Get Flood Insurance in Tennessee Flood insurance is easier to obtain than many people realize. At 615 Insurance, we can: • Evaluate your flood risk • Compare NFIP and private market options • Help you determine how much coverage you need • Bundle flood insurance with your home or renters policy for convenience Whether you're in Nashville, Franklin, Knoxville, or a small town in between, we're happy to help you find the right protection. 🏠 Do Renters and Condo Owners Need Flood Insurance? Yes. Flooding doesn’t just affect homeowners. Why? • Renters can purchase content-only flood insurance to protect their belongings. • Condo owners may need a personal policy to cover what the HOA master policy does not. Flooding in a lower-level unit, basement storage, or even shared utility areas can damage your items—and most landlord or HOA policies won’t cover it. 🙋♀️ Still Not Sure If You Need It? Let’s Talk Tennessee’s weather isn’t getting calmer. If you’ve ever seen water pool near your home, noticed poor drainage, or watched storms flood nearby roads, you could be at risk—even outside of official flood zones. At 615 Insurance, we’re not here to scare you—we’re here to prepare you. Our job is to make sure you understand your risks and have the right coverage in place, long before the skies open up. 📞 Get Your Flood Quote Today Flood insurance is affordable, easy to add, and could save you thousands. Let’s find out if your home is at risk and make sure you’re protected. 📍 Call us at 615-809-1225 📧 Email Lance@615insured.com 🖥️ Or visit 615 Insurance to get started We’re local, we care, and we’re here to help you weather any storm—literally.

Life insurance is one of the most important financial tools available — yet it's also one of the most misunderstood. Thanks to outdated advice, misinformation, and assumptions, many people avoid buying coverage, delay it too long, or choose the wrong type of policy. The truth? Believing in common life insurance myths can cost you — and your family — more than you think. In this post, we’ll debunk the most common life insurance myths and explain how falling for them could impact your finances, your loved ones, and your future. Myth #1: "I’m Young and Healthy — I Don’t Need Life Insurance Yet" The Reality: The best time to buy life insurance is when you’re young and healthy. One of the biggest myths is that life insurance is only for older adults or parents. In reality, the younger and healthier you are, the cheaper your policy will be. Locking in a term life policy in your 20s or 30s could cost as little as $15–$30 a month, depending on the coverage. Waiting until you're older — or after a medical diagnosis — can lead to significantly higher premiums or even disqualification from coverage. Don’t assume you’re too young; buying now can save you money and guarantee protection down the line. Myth #2: "Life Insurance Is Too Expensive" The Reality: Most people overestimate the cost of life insurance — by a lot. According to LIMRA (Life Insurance Marketing and Research Association), many people think life insurance costs three times more than it actually does. For example, a healthy 30-year-old could get a 20-year, $500,000 term policy for around $25 per month. That’s less than a dollar a day — about the cost of one coffee. Life insurance is surprisingly affordable, especially term life. You can choose coverage that fits your budget and increase it as your financial situation improves. Myth #3: "My Job’s Life Insurance Is Enough" The Reality: Employer-sponsored life insurance is helpful — but usually not enough. Most employer policies only cover 1–2x your annual salary, which isn’t enough to cover long-term needs like: • Mortgage payments • College tuition • Everyday living expenses for your dependents • Final expenses like funeral costs Plus, you lose that coverage when you leave your job. Having your own individual policy ensures that you stay covered no matter where your career takes you — and that your family gets the protection they truly need. Myth #4: "Only Breadwinners Need Life Insurance" The Reality: Stay-at-home parents and caregivers also need coverage. Many people assume that only the income-earner needs life insurance. But consider this: if a stay-at-home parent passes away, the surviving spouse may need to pay for: • Childcare or daycare • Meal preparation • Housekeeping • Transportation • Emotional support services for children These costs can add up quickly. Life insurance for non-working spouses or caregivers provides the financial flexibility needed to maintain stability and quality of life. Myth #5: "I Don’t Have Kids or a Spouse, So I Don’t Need It" The Reality: Life insurance protects more than just dependents. Even if you’re single with no children, life insurance can: • Cover funeral and burial expenses • Pay off student loans or other debts (especially if co-signed) • Leave a gift or legacy for loved ones or charities • Lock in low rates while you’re young If you wait until you “need” life insurance, you might pay more or face medical disqualification. Planning ahead provides peace of mind and financial protection for the people and causes you care about. Myth #6: "I Can’t Get Life Insurance With a Health Condition" The Reality: You can still qualify — and options have expanded. Even if you have a pre-existing condition, such as diabetes, high blood pressure, or anxiety, you may still qualify for life insurance. The key is working with a knowledgeable agent who can help you shop across different carriers. Some policies also offer no-medical-exam options, which are great for people with minor conditions or those who want fast coverage. While you may pay a little more than someone in perfect health, some coverage is better than none. Myth #7: "Term Life Insurance Is Always Better Than Whole Life" The Reality: It depends on your needs and goals. Term life insurance is great for most young families. It provides large coverage amounts for low monthly costs and lasts a set number of years (typically 10–30). But permanent policies, such as whole life or universal life, also offer: • Lifetime coverage • A cash value component that grows tax-deferred • The ability to borrow or withdraw funds later in life Permanent insurance is ideal for people who want to build wealth, leave a legacy, or guarantee coverage regardless of health changes. It's not "better" or "worse" — it's about what’s right for your situation. Myth #8: "I Don’t Need Life Insurance Because I Have Savings" The Reality: Life insurance multiplies your financial impact. Even if you’ve built up some savings, think about this: if you pass away tomorrow, would your savings be enough to: • Replace decades of lost income? • Cover your mortgage and debts? • Fund your children’s education? Life insurance instantly creates a financial safety net — often worth hundreds of thousands of dollars — for a fraction of what you’d need to save yourself. It’s not either/or. It’s savings plus insurance for full protection. Myth #9: "Life Insurance Payouts Are Taxed" The Reality: In most cases, life insurance benefits are tax-free. When your beneficiaries receive the death benefit from your life insurance policy, it’s typically not subject to federal income tax. That means they get to use the full amount for: • Paying off debt • Replacing income • Covering final expenses • Investing in the future There are a few exceptions — such as if the policy is part of a business or estate — but for most individuals and families, life insurance proceeds are 100% tax-free. Myth #10: "Buying Life Insurance Is Complicated" The Reality: It’s easier than ever to get covered. With modern technology, many insurers now offer: • Online applications • No medical exams • Instant approval for qualified applicants You can get quotes, compare policies, and buy coverage all from your phone or laptop — often in less than 30 minutes. Working with a local agent can also simplify the process and help you find the best policy for your needs and budget. Final Thoughts: Don’t Let Myths Delay Protection Life insurance is one of the simplest, most affordable ways to protect the people you love — but misinformation holds too many people back. Whether you're single or married, young or middle-aged, wealthy or still building, there's a life insurance policy that fits your needs. Don’t wait until it’s too late or too expensive. Understanding the truth now can save your family from financial stress later. ✅ Next Steps: • Review your current policy, if you have one • Talk to a licensed insurance agent to explore your options • Get a free quote to see how affordable coverage really is 📣 Need Help? Our team specializes in helping individuals and families cut through confusion and get the right coverage at the right price. Contact us today for a no-obligation consultation.

Tennessee is known for its rich musical heritage, scenic beauty, and southern hospitality—but it’s also known for its unpredictable weather. Spring and early summer often bring severe thunderstorms that can quickly evolve into dangerous tornadoes. In fact, the state averages about 30 tornadoes a year , with Middle and West Tennessee being particularly vulnerable. For residents and property owners, preparation isn’t just about boarding up windows—it’s also about making sure you’re protected financially and legally through proper insurance coverage. At 615 Insurance, we believe being proactive can make all the difference when tornado season arrives. Here’s your comprehensive guide to preparing for tornado season in Tennessee—from an insurance perspective. 1. Understand the Tornado Risks in Tennessee Tennessee is in a region often referred to as “Dixie Alley,” an area in the southeastern U.S. that experiences frequent and sometimes deadly tornadoes. Unlike “Tornado Alley” in the Midwest, Dixie Alley storms often occur at night and outside the traditional spring tornado season, which makes them especially dangerous. Some counties in Tennessee, including Davidson , Shelby , and Rutherford , have been struck multiple times in recent years. As your local insurance provider, we stay up to date with weather trends and FEMA data to help you stay protected year-round— not just during peak months . 2. Review Your Homeowners Insurance Coverage Many homeowners believe that tornado damage is automatically covered by their insurance, but that’s not always the case—especially when it comes to specific exclusions, deductibles, or policy limits. Here’s what to check: ✅ Dwelling Coverage Limits Make sure your policy covers the full cost to rebuild your home—not just the market value. In tornado-prone areas, replacement cost coverage is essential. ✅ Wind and Hail Deductibles Some policies have a separate deductible specifically for wind or hail damage, which can be higher than your standard deductible. Know what yours is and whether it’s a flat amount or a percentage of your home's value. ✅ Detached Structures Garages, sheds, fences, and other structures may not be fully covered under your standard dwelling coverage. Check the limits on “Other Structures” in your policy. ✅ Loss of Use / Additional Living Expenses (ALE) If your home becomes uninhabitable due to tornado damage, will your policy help cover hotel stays, meals, or temporary housing? This is one of the most overlooked yet critical coverages to have. 3. Inventory Your Possessions Now—Before the Storm Documenting what you own can significantly speed up your claims process . Tornadoes can destroy everything in their path, leaving little to nothing behind. Creating a digital home inventory gives you peace of mind and proof of what was lost. We recommend: • Taking photos or videos of each room • Saving purchase receipts and serial numbers • Using a digital app or spreadsheet that can be backed up to the cloud • Reviewing this inventory at least once a year If you’d like a free printable or digital inventory template, reach out to us—we’re happy to help. 4. Understand What’s NOT Covered Standard homeowners insurance does not cover flood damage. Tornadoes often come with torrential rain and storms that can cause flash flooding. If you live in a low-lying or high-risk flood area, consider purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private carrier. Additionally, check for these common exclusions: • Earth movement (sinkholes, landslides) • Mold or water damage from poor drainage • Pre-existing roof or structural issues If you're unsure what your policy excludes, bring it by our office or send it in for a free coverage review. 5. Prepare Your Property Physically Insurance is essential, but physical preparation can help reduce the risk of damage in the first place. Here are steps to take before a storm: • Trim dead tree limbs that could fall on your home • Secure loose items like patio furniture, grills, and garbage cans • Reinforce garage doors, which are vulnerable to wind damage • Clear gutters and downspouts to prevent water buildup • Anchor mobile homes or small structures to the ground Home improvements like storm shutters or reinforced roofing can also qualify you for premium discounts. Ask us if your upgrades might help you save. 6. Build a Tornado Emergency Kit Every family in Tennessee should have a tornado emergency kit ready to go. Your kit should include: • First-aid supplies • Flashlights with extra batteries • Battery-powered weather radio • Bottled water and non-perishable food • Phone chargers and backup batteries • Important documents (including a copy of your insurance policy) • Pet supplies if you have animals Store your kit in your designated storm shelter or interior room without windows—like a closet or bathroom. 7. Know the Claims Process Before You Need It When a tornado hits, emotions run high. Understanding how the insurance claims process works can save you frustration later. Here’s what to do: 1. Contact your agent ASAP – The sooner you report the claim, the sooner the process starts. 2. Document everything – Take photos and videos of the damage before cleaning up. 3. Prevent further damage – Cover exposed areas with tarps or plywood to avoid additional losses. 4. Keep receipts – For repairs, temporary lodging, or other out-of-pocket expenses. We recommend keeping your insurance agent’s contact info saved in your phone and written in your emergency kit. 8. Consider Additional Coverage Options If your home is in a high-risk area, or you simply want extra peace of mind, consider these supplemental coverages: • Extended Replacement Cost Coverage – Helps if rebuilding costs exceed your policy limits. • Debris Removal Coverage – Covers the cost of cleaning up storm wreckage. • Equipment Breakdown – Covers damaged appliances or HVAC units from power surges. • Business Interruption (for home-based businesses) – Replaces lost income if your operations are paused due to storm damage. A personalized policy review is the best way to see if any of these make sense for your home, budget, and risk level. 9. Stay Weather-Aware During Tornado Season The best defense is awareness. Sign up for local weather alerts from the National Weather Service and download a trusted weather app. If a tornado warning is issued, take it seriously and head to your designated shelter area immediately. Being prepared doesn’t mean being scared —it means being ready. And your insurance coverage should be just as ready as your emergency kit. Final Thoughts: Let Us Help You Weather the Storm Tornadoes may be part of life in Tennessee, but dealing with the aftermath doesn’t have to be overwhelming. At 615 Insurance, we’re not just here to sell policies—we’re here to be your trusted partner when it matters most. Let’s make sure your coverage is built for Tennessee’s unique risks. Call us today or schedule a free policy review. We’re happy to help you prepare, protect, and recover—no matter what the skies may bring. Need help reviewing your policy or updating your coverage before tornado season? Contact us at (615)809-1225 or email Lance@615insured.com—we’re local, we’re ready, and we care.

Life insurance might seem like something to worry about later in life—after you’ve settled down, bought a house, or started a family. But in reality, your 20s and early 30s are the best time to secure life insurance. While no one wants to think about the worst-case scenario, taking action early can save you money, reduce stress for loved ones, and become an important part of your long-term financial strategy. Here are 10 powerful reasons young adults shouldn’t wait to buy life insurance : 1. Life Insurance Is Cheapest When You're Young and Healthy The cost of life insurance increases with age —and health conditions. A 25-year-old in good health might pay as little as $15–$25 per month for a term life policy with $250,000 to $500,000 in coverage. That same person might pay double or triple that amount if they wait until their 40s or 50s. Why pay more later when you can lock in low rates now ? Many term life insurance policies allow you to secure a fixed rate for 20–30 years. Even if your health changes down the road, you’ll keep the low premium you qualified for in your youth. 2. You’re More Likely to Be Approved While You're Healthy Approval for life insurance isn’t guaranteed. If you develop a health condition later—diabetes, high blood pressure, or even anxiety—you might face higher rates or outright denial. Insurers evaluate applicants based on risk, and younger applicants are generally seen as lower risk. Even small health changes can impact your eligibility. Getting insured now, while you’re at peak health, means fewer hoops to jump through and better policy options to choose from. 3. Protect Loved Ones From Financial Burden Even if you're not married or don’t have children, your passing could leave others financially impacted. Consider: • Funeral and burial costs , which can easily exceed $10,000 • Shared loans or co-signed debt • Medical bills that your estate might be responsible for Having life insurance ensures that your parents, siblings, or partner aren’t left scrambling to cover these costs. A small term policy could make all the difference in giving them time and space to grieve, not worry about money. 4. Cover Student Loans and Other Debt Federal student loans are typically forgiven upon death—but private loans often aren’t. If a parent or loved one co-signed your loan, they could be legally responsible for paying the remainder. The same goes for car loans, credit cards, or personal loans. A life insurance policy can provide enough coverage to pay off your debt , protect your co-signers, and ensure no one is burdened financially. 5. Build a Strong Financial Foundation Early Your 20s and 30s are all about building a solid financial base. Just like you start budgeting, saving, or investing early, buying life insurance is another key step. It reflects foresight, maturity, and responsibility. Plus, some policies (like whole life insurance) accumulate cash value over time , giving you another tool for building wealth. More on that in the next point. 6. Take Advantage of Cash Value Growth (With Permanent Policies) While term life insurance is more affordable and straightforward, permanent life insurance (like whole or universal life) includes a cash value component that grows over time—tax-deferred . Starting a cash-value policy at a younger age gives that value more time to grow. You can later borrow against it for: • A home down payment • Business funding • College tuition • Or even retirement income It’s not for everyone, but for those with long-term financial goals, starting early with permanent life insurance can be part of a diversified financial strategy. 7. Prepare for Future Life Changes Before They Happen Life moves fast. One year you’re single, the next you’re married with a baby on the way. If you wait until you "need" life insurance, you might miss the chance to get affordable rates—or worse, experience a medical event that makes you uninsurable. Buying life insurance now means you’re prepared for whatever life throws your way. And if you get convertible term insurance, you can later upgrade your policy to permanent coverage without needing a medical exam . This way, you’re not only protecting your present— you’re securing your future, too. 8. Group Life Insurance from Work Might Not Be Enough Many young professionals receive life insurance through their employers. That’s a great start—but here’s the catch: it’s usually limited, often covering only 1–2x your salary. That’s rarely enough for long-term needs like paying off debts, supporting a family, or covering final expenses. Even worse? If you leave your job, you usually lose your coverage. Buying your own individual policy ensures: • Control over your coverage • Portability regardless of employment • Higher limits based on your actual needs Supplementing your workplace coverage with your own policy gives you peace of mind and real protection. 9. Shows Responsibility and Maturity Let’s be honest: a lot of young adults don’t think about life insurance because it forces them to think about uncomfortable possibilities. But the decision to buy life insurance isn’t about fear—it’s about being proactive. You’re telling your future spouse, children, or loved ones: “I care about your future—even if I’m not here to see it.” That’s a powerful, grown-up move that reflects real maturity and long-term thinking. Whether or not people depend on you today, they likely will someday. Why not prepare now? 10. Peace of Mind—For You and Your Family There’s no price tag on peace of mind. Knowing that you’ve put safety nets in place for the people you care about (and even yourself) is deeply reassuring. Life is unpredictable . While no one wants to imagine their life being cut short, knowing that your debts, expenses, and loved ones would be taken care of gives you the confidence to live freely, knowing you’ve done your part. Bonus: It’s Easier Than Ever to Get Started Years ago, buying life insurance meant a lot of paperwork, medical exams, and long waits. Today, many providers offer: • No-exam policies • Online applications • Instant approvals That means you can get a quote, compare policies, and be fully insured in just a few minutes— all from your phone or laptop. So if complexity or inconvenience is holding you back, rest assured: life insurance has never been more accessible. Final Thoughts: Invest in Protection While It’s Easy and Affordable Life insurance isn’t just for married couples or parents—it’s for anyone who wants to protect their future and those they love. It’s a proactive financial tool that becomes more expensive (or harder to get) the longer you wait. If you're a young adult, now is the ideal time to buy life insurance because: • You’ll pay lower premiums • You’re likely in great health • You can protect loved ones from financial hardship • You can build long-term wealth and security Whether you choose term or permanent life insurance, the most important thing is to get started . Even a modest policy can make a huge difference—and lay the foundation for smarter financial planning in the years ahead. Need help finding the right life insurance policy? Reach out to a licensed insurance agent or broker who can walk you through your options and tailor coverage to your goals. The peace of mind is worth it. GET A LIFE INSURANCE QUOTE TODAY

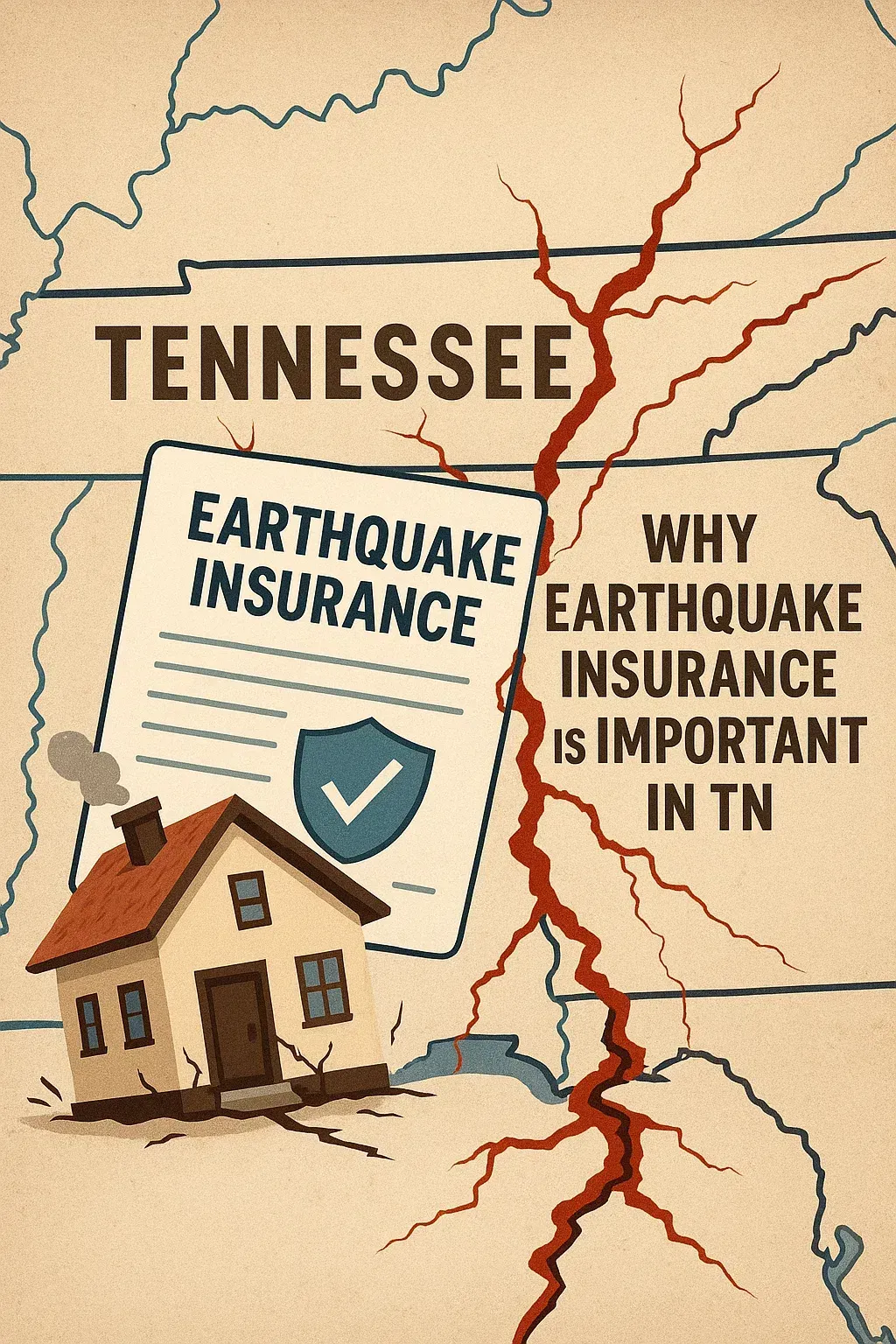

Tennessee is known for its rolling hills, southern charm, and musical legacy—but if you’ve lived here long enough, you also know this truth: Tennessee weather can be wild, unpredictable, and destructive. From sudden snowstorms to severe thunderstorms, flash floods to tornadoes, and even the occasional earthquake, Mother Nature doesn’t hold back in the Volunteer State. And when disaster strikes, having the right insurance coverage—not just a basic policy—is what separates peace of mind from costly regret. At 615 Insurance, we help Tennessee families and homeowners prepare for every kind of weather event this state throws their way. Below, we break down the major weather threats in Tennessee and the insurance coverages you need to be fully protected. 🌪️ Tornadoes & High Winds Tennessee is part of Dixie Alley, a region known for violent tornadoes, especially in spring and early summer. These storms bring high winds, hail, and sudden destruction—often in the middle of the night, with little warning. Coverage You Need: • Dwelling Coverage: Make sure your homeowner's policy includes wind damage and is based on replacement cost, not actual cash value. • Wind/Hail Deductible: Many Tennessee policies have separate, higher deductibles for wind and hail. Know your deductible before a storm hits. • Loss of Use / ALE (Additional Living Expenses): This pays for hotel stays and living costs if your home is uninhabitable. • Debris Removal: Covers cleanup and removal of fallen trees, building materials, etc., after a storm. Pro Tip: Ask your agent if your garage door and roof materials qualify for wind mitigation discounts—some improvements can lower your premium. ⛈️ Severe Thunderstorms & Lightning Thunderstorms are common in Tennessee, especially from March to October. In addition to heavy rain and strong winds, they often bring lightning strikes, which can cause power surges, fires, and electrical damage. Coverage You Need: • Personal Property Coverage: Ensures your belongings—electronics, appliances, furniture—are protected from fire and surge damage. • Equipment Breakdown Coverage: Not always standard, but incredibly useful. Covers mechanical failures caused by electrical surges, including HVAC systems and major appliances. • Roof Coverage: If your roof is older, make sure you’re not limited to depreciated value (ACV). You may need to upgrade to replacement cost. Pro Tip: Keep an updated home inventory (photos, receipts, serial numbers). It makes filing claims faster and easier. 🌧️ Flash Flooding Tennessee sees frequent flash floods, especially in Middle and East Tennessee, where rivers, creeks, and steep terrain can cause water to rise in minutes. Unfortunately, most standard homeowners policies do not cover flood damage. Coverage You Need: • Flood Insurance: A separate policy required for coverage. You can get it through the National Flood Insurance Program (NFIP) or a private carrier. It covers damage to the building and your contents caused by rising water. • Sewer/Drain Backup Coverage: This is an optional add-on that protects you if water backs up through sewers or sump pumps—not always covered by flood insurance. • Foundation Water Protection: Some private insurers offer enhanced endorsements to cover seepage into basements or crawlspaces. Pro Tip: Just one inch of water can cause up to $25,000 in damage. You don’t have to live in a “flood zone” to be at risk. ❄️ Winter Weather & Ice Storms Tennessee may not be the coldest state, but we see enough ice storms and occasional snowfalls to create chaos—especially for homeowners. Ice buildup can damage roofs, cause frozen pipes, and lead to dangerous slips and falls. Coverage You Need: • Frozen Pipe Coverage: Most policies cover this if you've taken steps to prevent freezing (like maintaining heat). • Roof Collapse: Covered if the roof gives way due to weight of snow or ice. Check your policy’s limits and conditions. • Liability Coverage: Protects you if someone slips on ice on your property and gets injured. • Service Line Coverage: Covers breaks in underground pipes (like water or sewer lines), which can happen during winter freeze-thaw cycles. Pro Tip: Keep your home heated above 55°F and insulate pipes near exterior walls to reduce risk. 🌫️ Fog, Landslides, and Earthquakes While less common, Tennessee has seen landslides, sinkholes, and even earthquakes—especially in West Tennessee near the New Madrid Seismic Zone. Coverage You Need: • Earthquake Insurance: Typically excluded from homeowners policies. This separate endorsement or policy covers structural damage, cracked foundations, and destroyed belongings. • Sinkhole Coverage: Required in some areas, optional in others. Tennessee law requires insurers to offer it, but you must opt in. • Landslide Protection: Often excluded from both homeowners and earthquake policies. Some private insurers offer riders to include it. Pro Tip: Even a mild earthquake can cause foundation cracks that impact your home’s long-term integrity. Standard insurance won’t help unless you’ve added earthquake protection. 🔥 Wildfires & Heat Waves While not as common as other disasters, wildfires and extreme heat have become more of a threat in Tennessee, particularly in drier seasons. The 2016 Gatlinburg fires were a tragic reminder that fires can spread fast and cause massive destruction. Coverage You Need: • Fire Damage (Included in Standard Policy): Covers your home and personal belongings. • Personal Property Inventory: A documented list of everything you own speeds up fire claims. • Evacuation Expense / Loss of Use: Pays for hotels, meals, and living costs while you’re displaced. Pro Tip: Many policies now have sublimits on certain valuable items (jewelry, art, electronics). Make sure your big-ticket items are scheduled or insured at full value. ✅ Putting It All Together: Your Weather-Proof Insurance Plan Tennessee weather doesn’t play by the rules. That’s why your insurance coverage shouldn’t be a one-size-fits-all policy. You need a plan that reflects where you live, how you live, and what you value. Here’s a checklist of recommended coverages for TN weather: Coverage Type Why You Need It Homeowners Insurance (Standard) Base protection against fire, wind, lightning Flood Insurance Separate policy Covers rising water damage Earthquake Insurance Protects against seismic activity in West TN Sewer Backup Covers sump pump or drain overflow Equipment Breakdown Pays for surge-damaged appliances/HVAC Wind/Hail Deductible Review Know what you’ll pay out-of-pocket ALE (Loss of Use) Helps if you're temporarily displaced Debris Removal Helps pay for cleanup after storms Personal Property Inventory Speeds up claims and reimbursement 🏡 Let Us Help You Weather Tennessee’s Worst Tennessee’s weather might keep us on our toes, but the right insurance coverage keeps you grounded. At 615 Insurance, we’re proud to serve Tennessee families by offering local expertise, personalized service, and proactive protection. Whether you're a homeowner in Nashville, a renter in Chattanooga, or own a cabin in the Smokies, we can tailor your coverage to fit the risks you actually face. Want a free policy review or flood/earthquake quote? Call us at 615-809-1225 or email Lance@615insured.com today—we’ll make sure your coverage isn’t just “good enough,” but truly weather-ready.

When you think of earthquakes, your mind probably jumps to California or Alaska—places with frequent seismic activity and major fault lines. But what if we told you that Tennessee, right here in the heart of the South, is actually one of the most earthquake-prone states in the U.S.? It’s true—and yet, most homeowners in Tennessee are dangerously underprepared when it comes to earthquake insurance. While standard homeowners insurance policies typically cover fire, wind, hail, and theft, they almost never cover earthquake damage. That leaves a significant gap in protection for thousands of Tennesseans. Let’s take a deeper look at why earthquake coverage is so important for Tennessee residents, especially if you own a home or rental property. The Quiet But Serious Threat: Earthquakes in Tennessee You might be surprised to learn that Tennessee sits along one of the most dangerous seismic zones in the eastern United States—the New Madrid Seismic Zone (NMSZ). This fault line stretches across southeastern Missouri, northeastern Arkansas, western Tennessee, western Kentucky, and southern Illinois. While it doesn’t make headlines often, the NMSZ has a frightening history. In the winter of 1811–1812, a series of powerful quakes shook the region, including three estimated to be above magnitude 7.0. These quakes caused the Mississippi River to briefly flow backward and reshaped the land in dramatic ways. Scientists agree that it’s not a matter of if another major earthquake will occur—it’s when. In fact, the U.S. Geological Survey estimates there’s a 7–10% chance of a magnitude 7.0 or greater quake occurring in the New Madrid zone within the next 50 years—and a 25–40% chance of a smaller, yet still damaging, magnitude 6.0 event. That puts much of West and Middle Tennessee—including Memphis, Jackson, and even parts of Nashville —at real risk. Why Most Tennesseans Are Uninsured Against Earthquakes Despite this risk, the vast majority of homeowners in Tennessee do not carry earthquake insurance. Why? There are a few reasons: 1. Lack of Awareness: Many people don’t realize Tennessee is at risk. 2. False Sense of Security: Since major earthquakes are rare, people think it “won’t happen to me.” 3. Cost Concerns: Earthquake insurance is often seen as optional or too expensive. 4. Misunderstanding Coverage: Many believe their homeowners policy includes earthquake protection—when it does not. This combination of factors has led to dangerously low coverage rates in a state with real seismic risk. The Financial Devastation of an Uninsured Earthquake The average homeowners policy excludes “earth movement,” meaning any damage from an earthquake—whether it’s cracked foundations, collapsed walls, or broken pipes —is not covered unless you have a separate earthquake endorsement or policy. Consider this: if a moderate quake causes $100,000 in structural damage to your home and you don’t have coverage, you could be left paying that entire cost out-of-pocket. Now imagine a more severe event. In a worst-case scenario, your home might be uninhabitable. You might face not only repair costs, but also: • Temporary housing expenses • Loss of personal property • Mortgage payments on a damaged or destroyed home • Structural upgrades required by new building codes Without earthquake insurance, none of these would be reimbursed. Earthquake Coverage: What It Typically Includes Earthquake insurance is either offered as a standalone policy or an endorsement (add-on) to your existing homeowners insurance. While coverage can vary, a standard earthquake policy generally includes: • Dwelling Coverage: Pays to repair or rebuild your home. • Personal Property: Covers damaged belongings like furniture, electronics, and appliances. • Loss of Use (Additional Living Expenses): Covers hotel stays, meals, and temporary housing if your home is uninhabitable. • Other Structures: May include coverage for garages, sheds, or fences. It’s important to review the deductible carefully—most earthquake policies have a percentage-based deductible (commonly 10–20% of your home’s insured value), not a flat amount like traditional homeowners coverage . For example, if your home is insured for $250,000 and you have a 10% deductible, you’d be responsible for the first $25,000 in repairs. While that may seem steep, it’s a fraction of what you’d pay without any coverage. Why Tennessee Residents Should Act Now The unfortunate truth is that once an earthquake occurs, it's too late to buy coverage. Insurance companies won’t sell new policies in the immediate aftermath of a quake—or they may impose waiting periods. Given the unpredictability of seismic events and the high potential for loss, securing earthquake coverage before disaster strikes is crucial. And remember: even minor quakes can cause damage. Brick homes, older homes, and homes not built to modern seismic standards are especially vulnerable. Tennessee’s varied housing stock includes many such structures. Tennessee-Specific Considerations In addition to the New Madrid zone, parts of East Tennessee sit near the East Tennessee Seismic Zone (ETSZ)—another area of seismic concern. While less active than the New Madrid zone, it still produces regular small quakes and holds potential for larger events. Cities like Chattanooga, Knoxville, and surrounding areas may feel effects from this zone, making earthquake coverage a smart investment across the state—not just in the west. Also, Tennessee's geology—especially in the Mississippi embayment—can amplify shaking from distant quakes, increasing the potential for damage even far from the epicenter. Earthquake Coverage Is More Affordable Than You Think Many homeowners skip earthquake insurance assuming it’s too expensive. The truth? In Tennessee, policies are often surprisingly affordable, especially when compared to the potential cost of rebuilding a home or replacing all your belongings. Premiums vary based on: • Home location • Building materials (brick homes tend to cost more to insure) • Year built • Foundation type • Policy limits and deductible An independent insurance agent can help you shop multiple carriers to find a policy that fits your needs and budget. Final Thoughts: Peace of Mind Is Priceless Earthquakes don’t give you a warning. When the shaking starts, it’s too late to ask “am I covered?” For Tennessee residents, earthquake insurance isn’t just a luxury—it’s a smart, forward-thinking investment in your financial security. With scientific consensus pointing to future seismic activity in our region, protecting your home and assets is more important than ever. Whether you live in Memphis, Nashville, Jackson, or Knoxville, we strongly encourage you to review your current homeowners policy and talk to a licensed insurance professional about adding earthquake protection. At 615 Insurance, we’re here to help you assess your risk, explain your options, and find coverage that gives you peace of mind—no matter what comes your way. Need Help Navigating Earthquake Insurance? Our team at 615 Insurance is ready to help. Give us a call at 615-809-1225, email us at Lance@615insured.com, or stop by our office for a personalized consultation. We’ll walk you through the process and make sure you’re protected from the unexpected. Don’t wait for the ground to shake. Get the protection you need today.

615 Insurance Agency Blog